Andrew Fox

About Andrew Fox

Andrew Fox, 42, currently lives on the Upper West Side of New York.

He serves as Secretary of the Citi Foundation and Director of Trading and Data Management for Citi Community Investment and Development, where he is responsible for grant operations, data and information management, analytics and reporting, as well as IT governance. Before joining Citi, he worked in the Office of the Chief Operating Officer and General Counsel at the Andrew W. Mellon Foundation.

He holds degrees from the University of Massachusetts Amherst, Trinity College Dublin and University College Dublin, and is widely regarded as a “bridge” professional connecting philanthropic finance with capital markets investing.

Career Highlights

- At the Andrew W. Mellon Foundation, he worked deeply on large-scale foundation governance, grant compliance and program evaluation, gaining first-hand experience in how capital can be structured to generate social value.

- At Citi, he has led the build-out of a data-driven system for managing grants and impact investments, aligning financial returns and social outcomes within a single measurement framework.

- He specializes in building bridges between the public sector, philanthropic capital and public markets, combining rigorous risk and compliance standards with an understanding of structural opportunities in high-volatility and emerging asset classes.

Historical trading strategy

Historical update time: Dec 4, 2025, 11:23 AM ESTMarket Analysis

PDYN is entering a structurally favorable phase supported by expanding demand for AI-enabled autonomous systems, next-generation unmanned platforms, and U.S. defense-grade robotics software. As defense agencies and commercial operators accelerate adoption of autonomous flight, swarm coordination, and real-time decision intelligence, high-reliability AI mission software has become strategic infrastructure and PDYN is positioned directly at the center of this trend. From a fundamental perspective, the company is experiencing improving revenue visibility through expanding defense-contract pipelines, growing AI-service deployments, and the establishment of its dedicated Palladyne Defense division. Management has outlined a multi-year growth trajectory, projecting revenue to triple by 2026, supported by over $10M in contracted backlog and meaningful EBITDA contribution as deployments scale. Market appetite for U.S.-based defense-AI platforms remains exceptionally strong, and capital rotation continues to favor companies with verifiable operational output rather than conceptual exposure. Technically, PDYN has demonstrated resilient accumulation behavior, with persistent dip-buying interest across key support zones. Despite elevated volatility typical of small-cap defense-AI names, the medium-term structure remains constructive as long as the stock maintains support above recent consolidation levels. A confirmed breakout from current compression zones could re-rate the equity toward higher valuation bands as AI-defense demand accelerates. Key takeaway: PDYN stands out as a high-conviction name within the AI-autonomy and defense-robotics ecosystem supported by strengthening fundamentals, powerful sector catalysts, elevated government spending trends, and a favorable trend setup. Pullbacks offer disciplined entry opportunities, while the broader defense-AI cycle continues to serve as the primary upside driver.

Focus Areas

- 🔔 Purchase Details 🔔

- 📅 Transaction Date: December 4

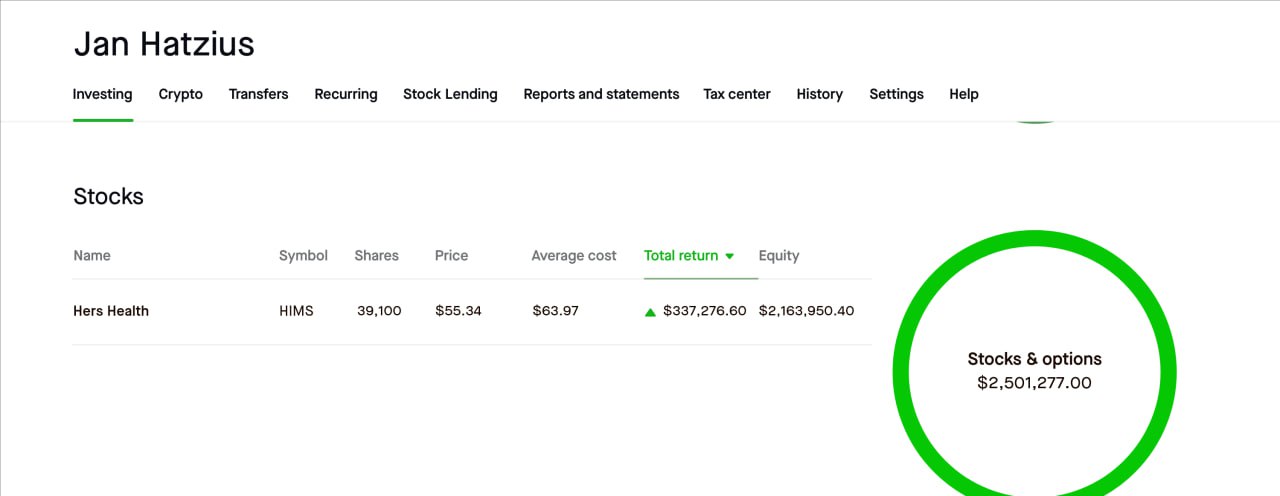

- ✅ Ticker: PDYN

- 🏢 Company: Palladyne AI Corp.

- 📈 Portfolio Allocation: 15%

Risk Warning

Market sentiment has improved slightly, yet underlying fragilities remain. Short-term rebounds are increasingly misaligned with tightening liquidity, persistent core inflation, and weakening market breadth. Federal Reserve & Liquidity: Expectations for early-2026 rate cuts face resistance as inflation remains sticky. Any upside surprise in CPI/PCE could trigger rapid valuation compression, especially in high-multiple growth sectors. Earnings & Structure: Index strength continues to rely on mega-caps, while small- and mid-caps face funding pressure and higher refinancing costs. Defensive sectors are absorbing institutional flows, raising the risk of sharp rotations. Yields & Valuation: The 10-year yield near 4.3%–4.4% limits valuation expansion and heightens re-pricing risk for long-duration equities. Markets remain sensitive to macro surprises. Macro & Geopolitics: U.S.–China tensions, Middle East risk, and fiscal uncertainty increase the probability of year-end volatility as liquidity continues tightening. Key Takeaway: Maintain disciplined risk management. Current resilience is positioning-driven, not conviction-driven. Prioritize capital preservation, avoid excessive leverage, and reduce concentrated exposure as markets enter a more volatile, data-dependent environment.

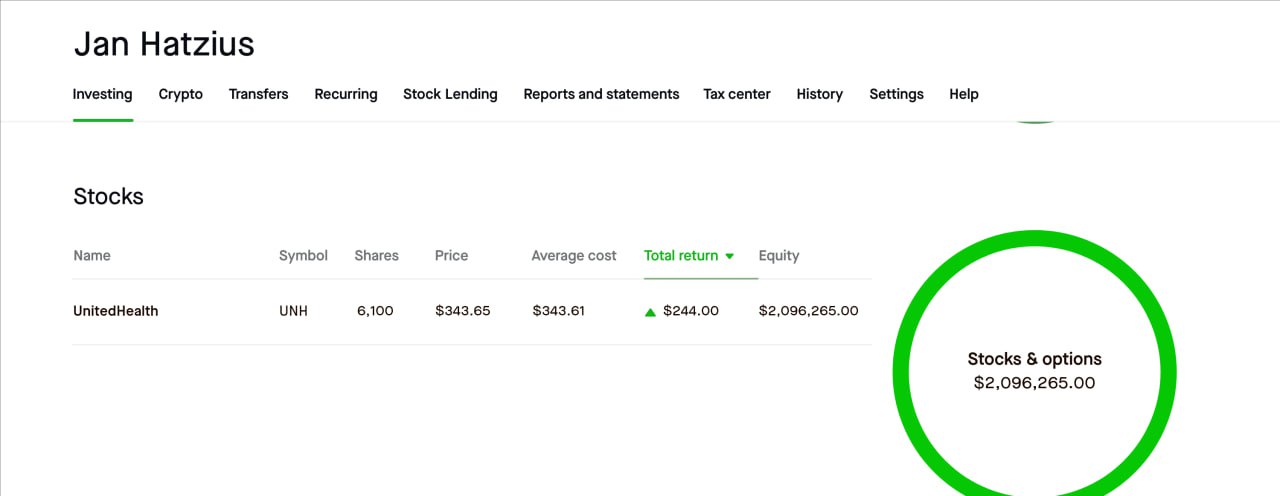

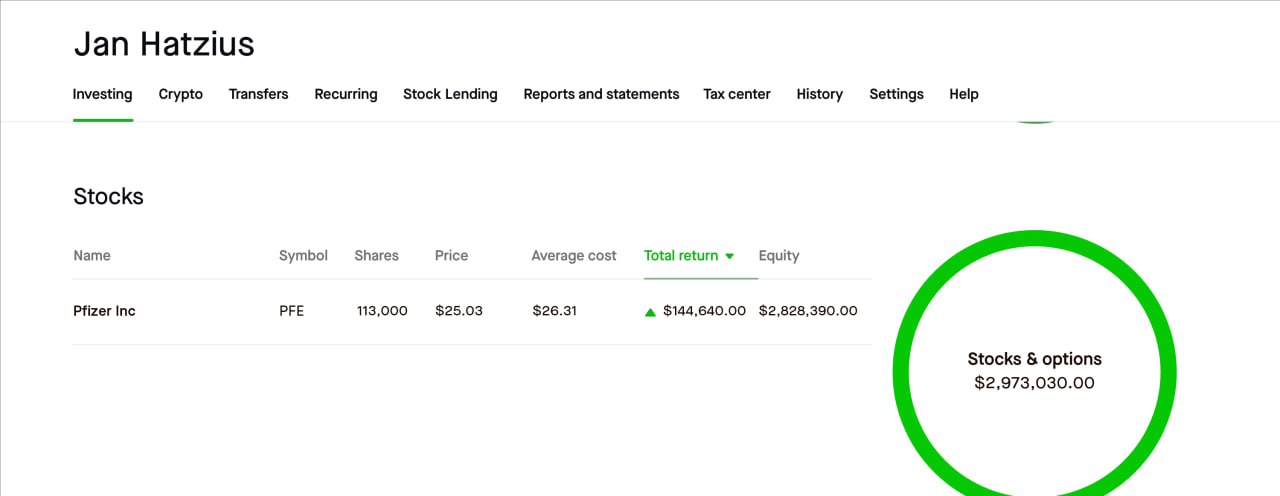

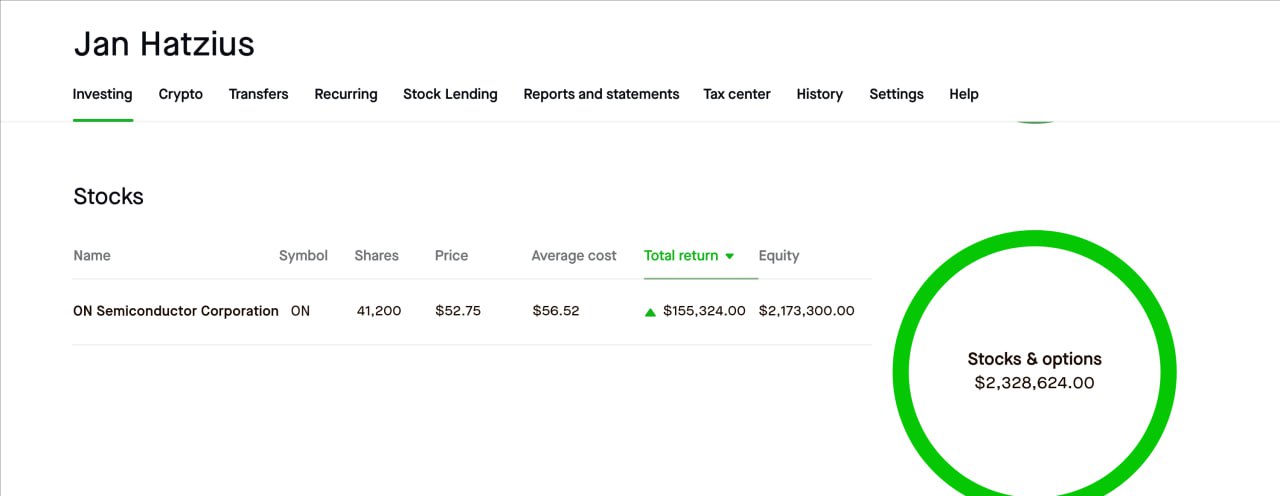

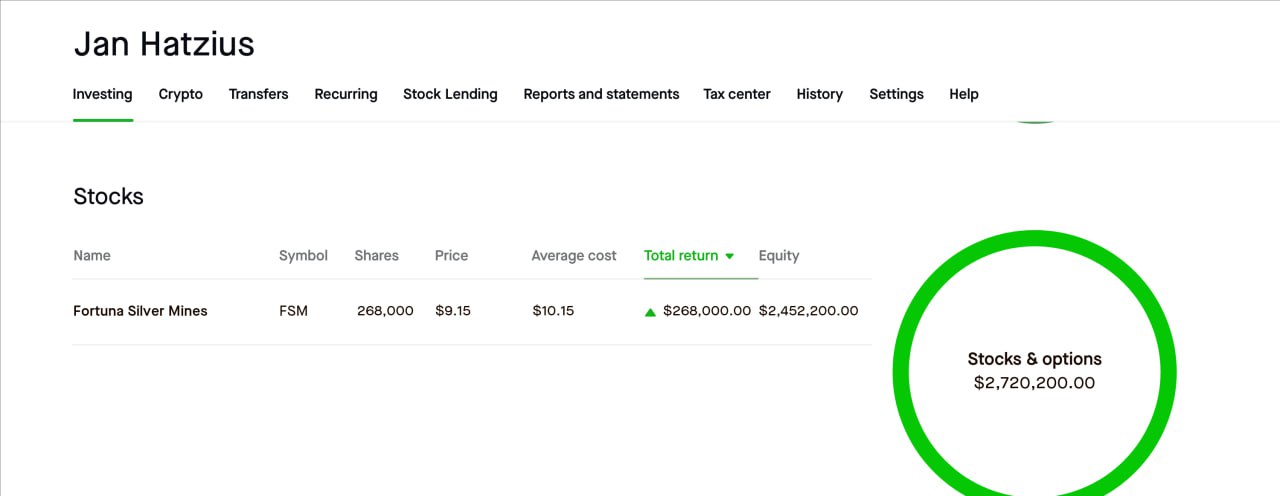

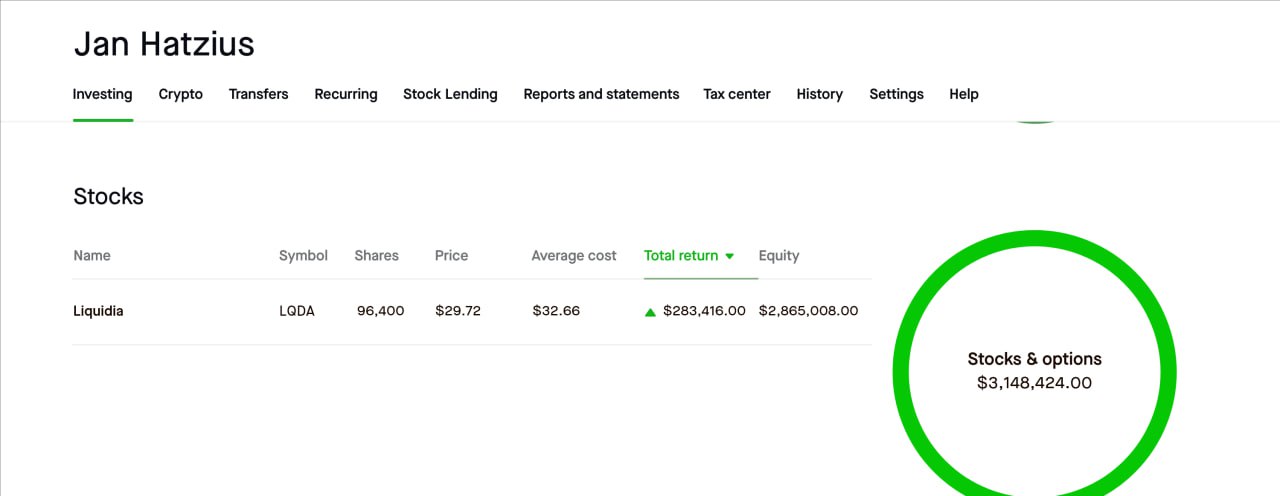

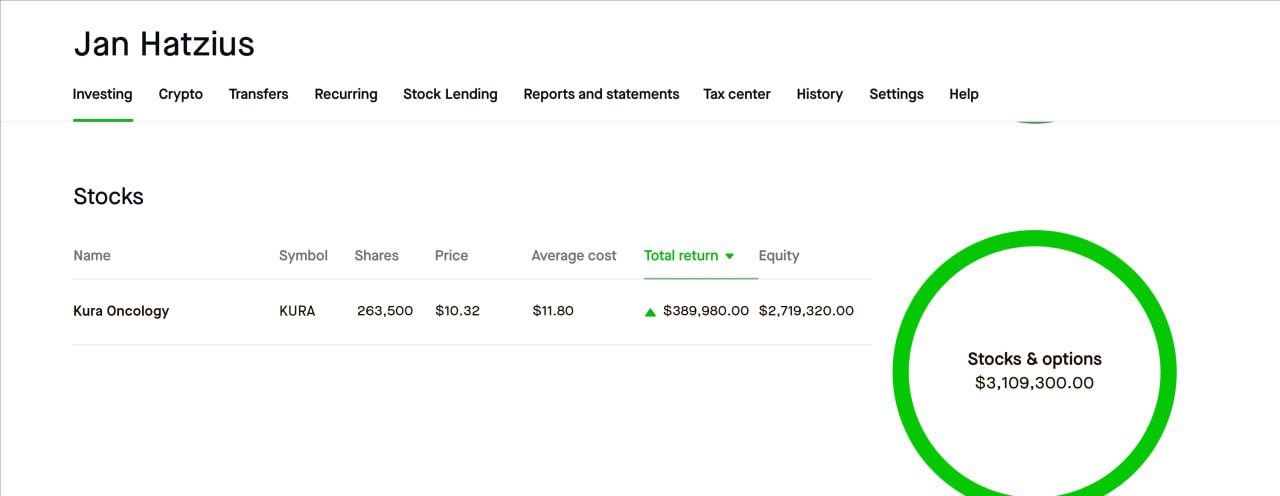

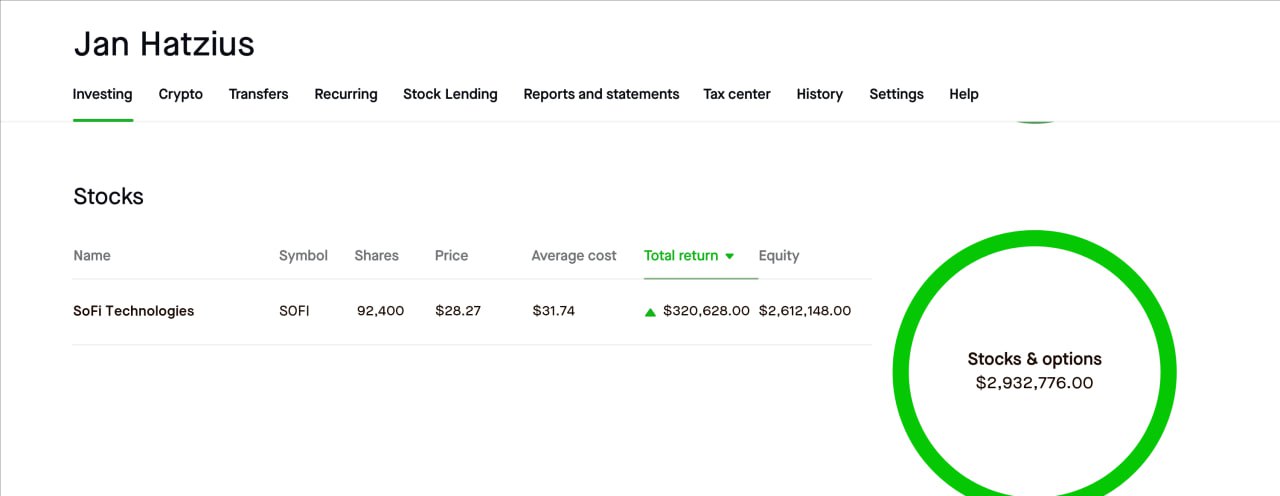

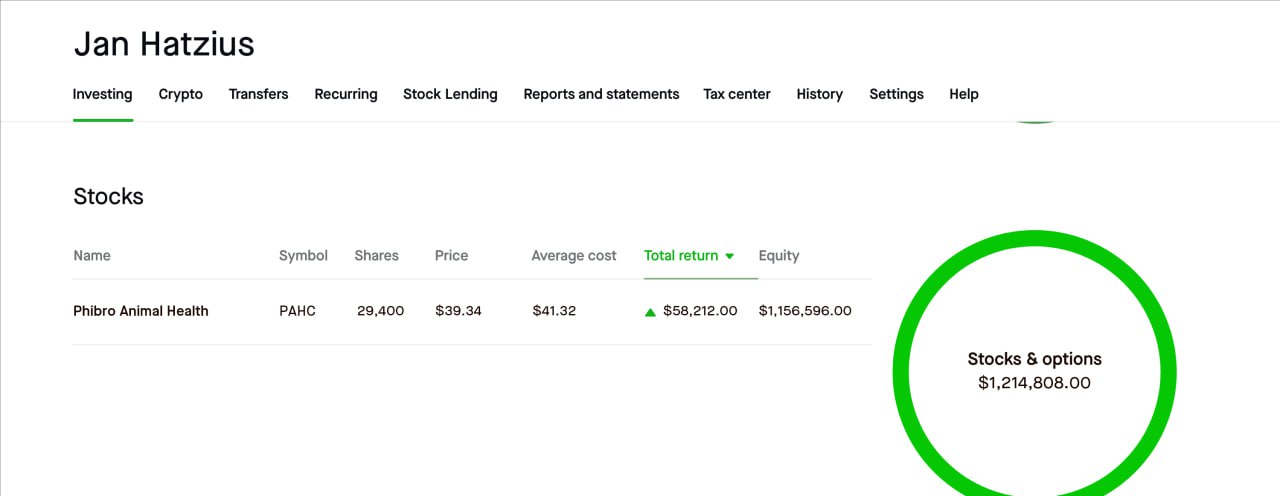

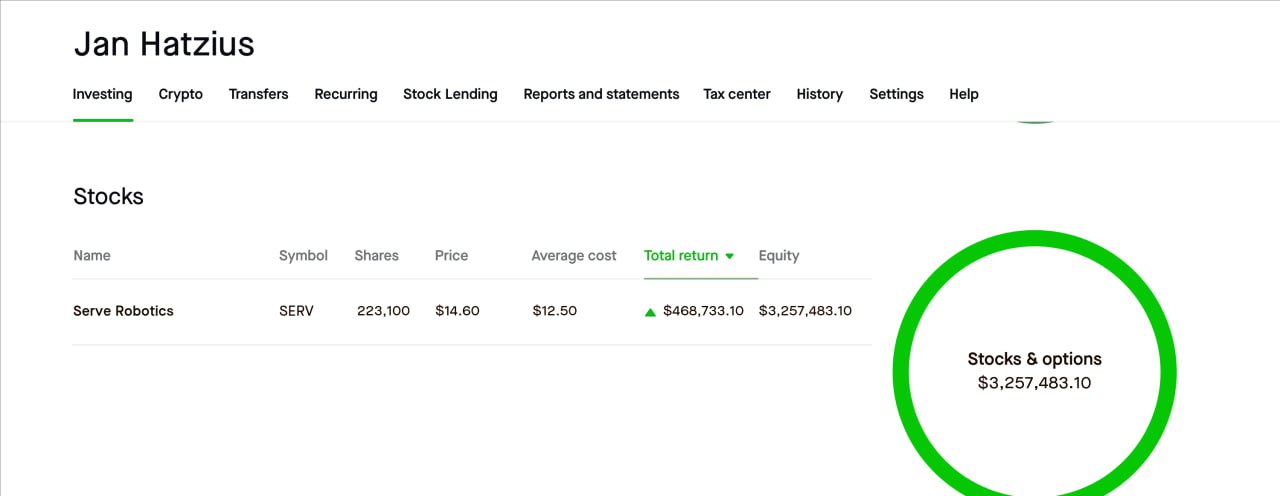

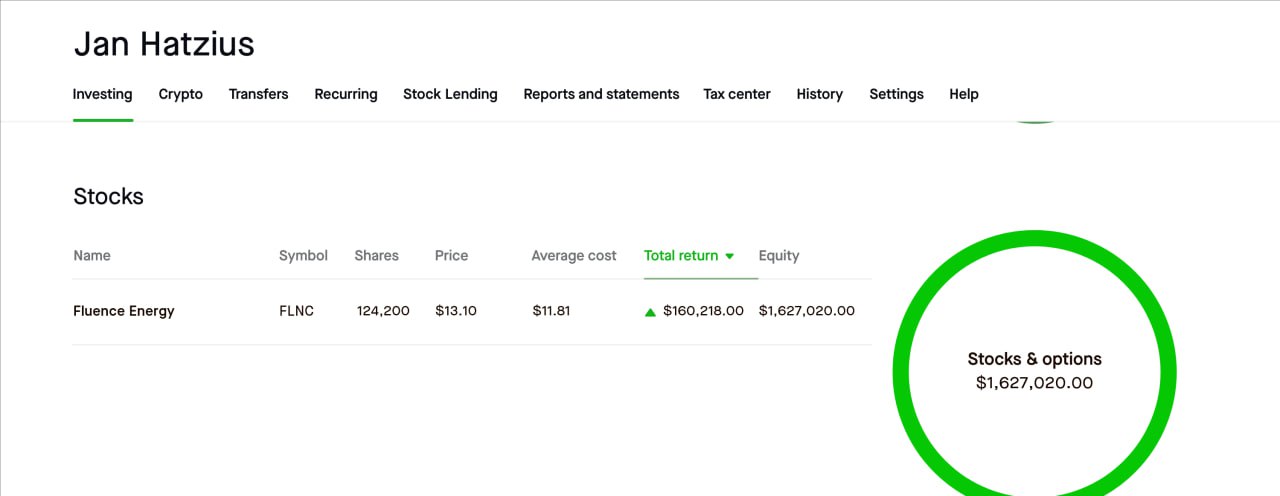

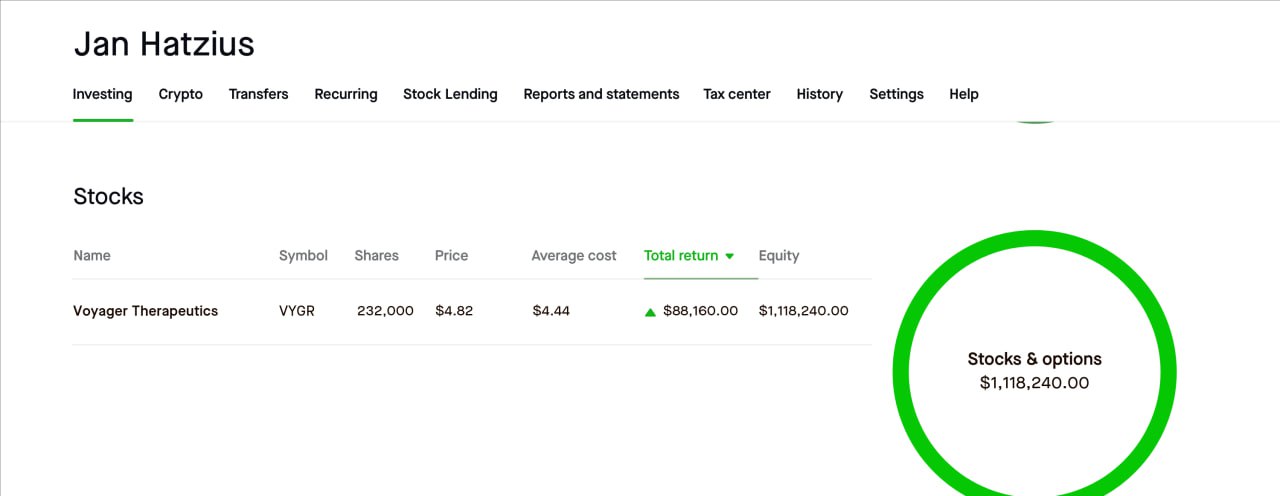

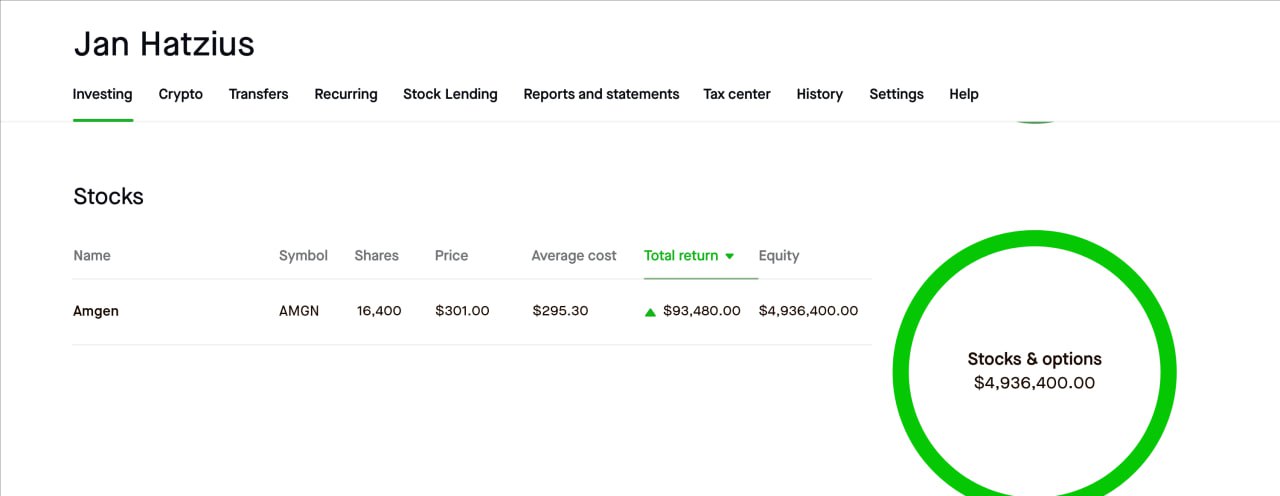

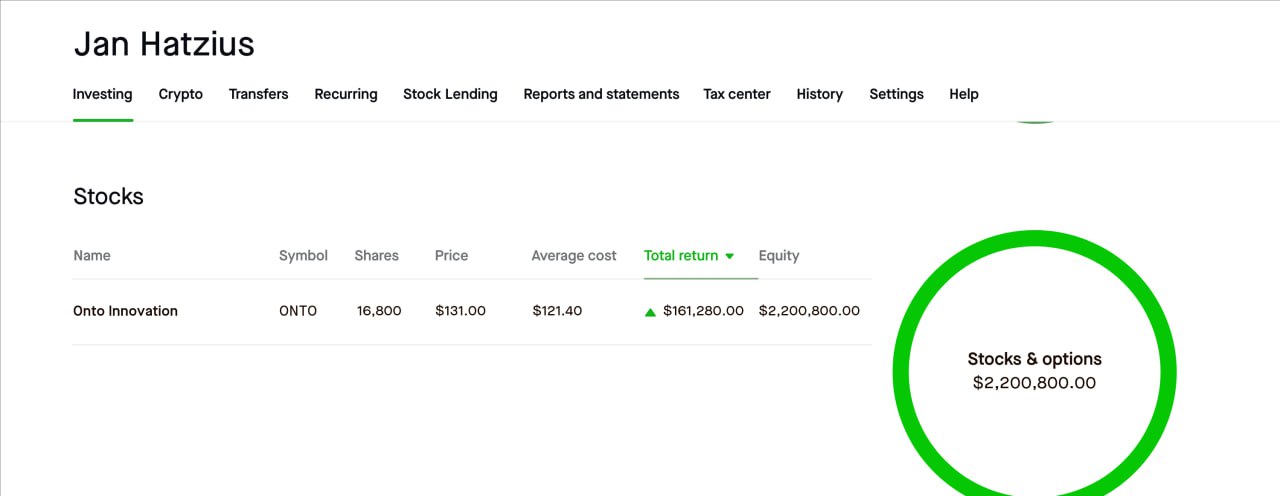

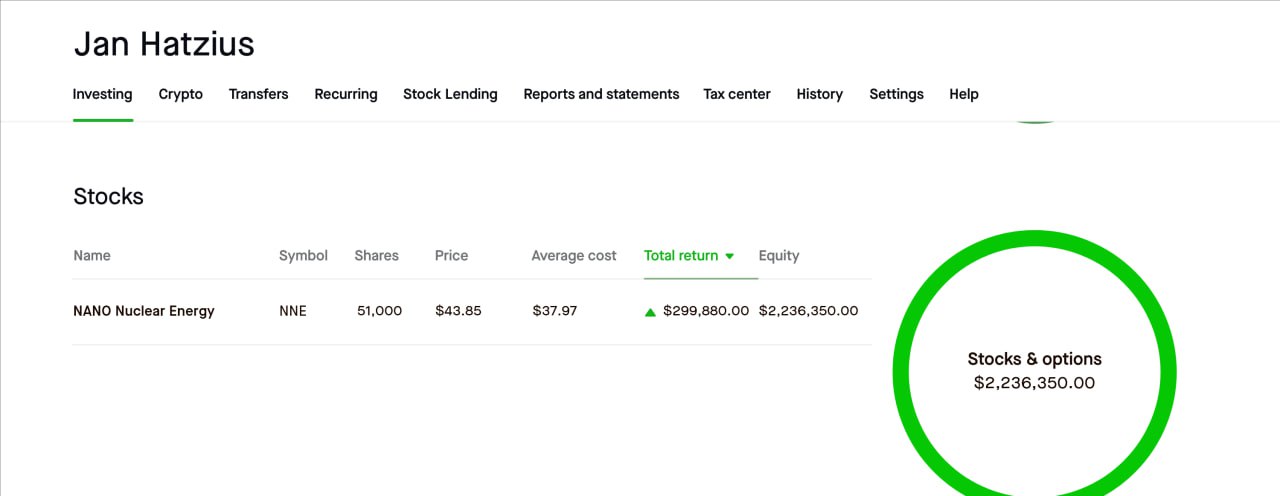

Trading Records (Last 1 Year)